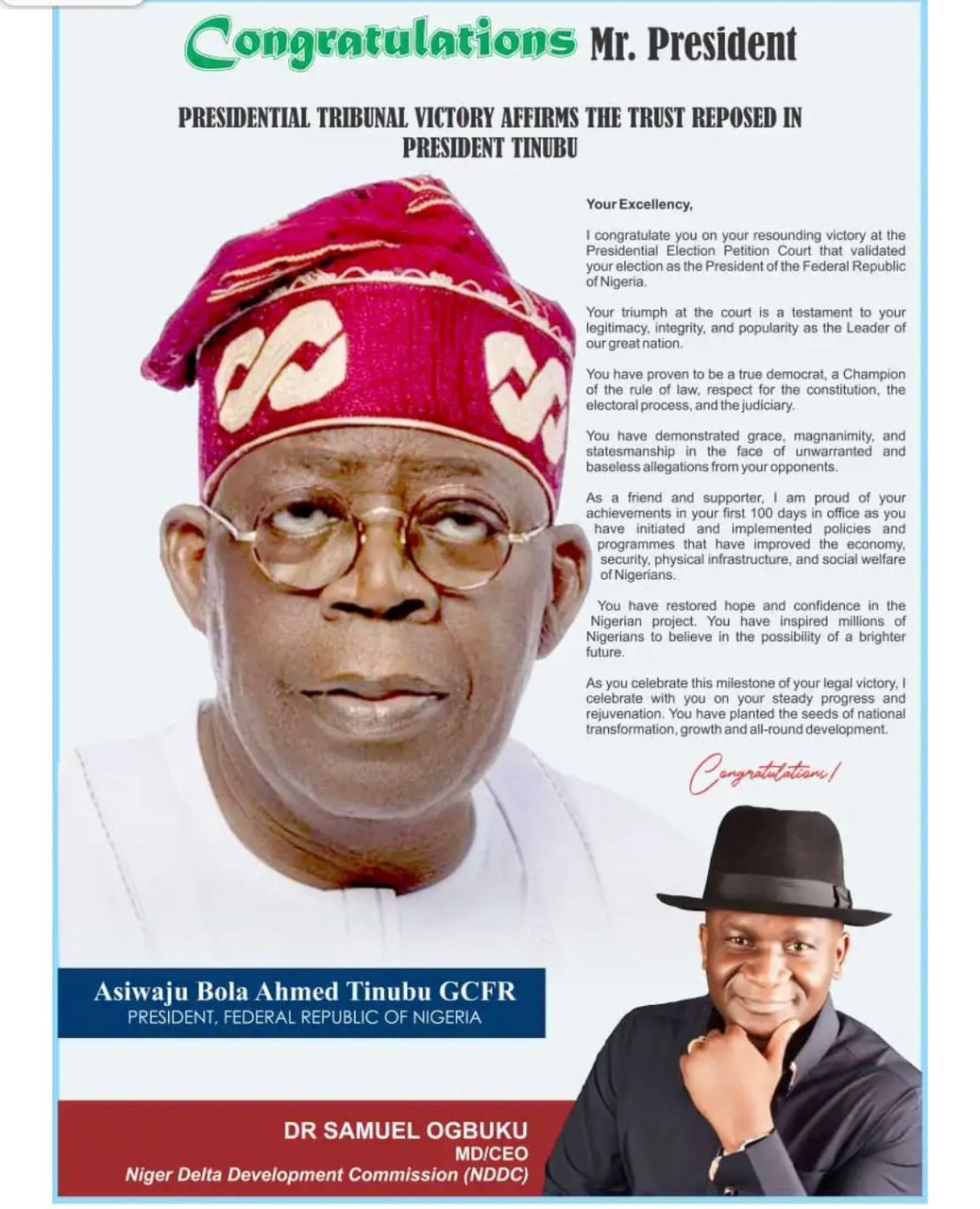

President Bola Tinubu said, on Sunday, that Nigeria would have gone bankrupt if his administration had not discontinued fuel subsidy payments.

He said though the policy came with economic pains, it was in the best interest of Nigerians.

Tinubu spoke at the Special World Economic Forum in Riyadh, Saudi Arabia.

Upon assuming office last May, Tinubu implemented the discontinuance of subsidies on petrol as prescribed by the immediate past administration of Muhammadu Buhari.

He said the move would save the government money for infrastructural expansion.

However, this move sparked collateral instability in the value of the Naira and heaped hardship on Nigerians as food prices soared.

At the WEF, Tinubu argued that removing the petrol subsidy was a “necessary action for my country not to go bankrupt” and to “reset the economy towards growth.”

Acknowledging the difficulties posed by the decision, the Nigerian leader told attendees that his government implemented parallel arrangements to cushion the impact on vulnerable citizens.

“Yes, there have been drawbacks. Yes, there was the expectation that a greater number of people would feel the difficulty, but, of course, I believed it was their interest that was the focus of government.

“It is easier to manage and explain the difficulties, but along the line, there was a parallel arrangement to cushion the effect of the subsidy removal on the vulnerable population of the country.

“We shared the pain across the board. We cannot but include those who are very vulnerable. Luckily, we have a very vibrant youthful population interested in discoveries by themselves, highly ready for technology, good education, and committed to growth,” Tinubu explained.

He also described the unification of the naira exchange rates as “necessary” to “remove the artificial element of value in our currency.”

The move, he argued, enabled the local currency to find its level, “compete with the rest of the world’s currencies, and remove arbitrage, corruption and opaqueness.”

Tinubu also emphasised the need for stability and economic prosperity in West Africa, saying, “We need to trade with one another, not fight each other.

“It is very, very necessary and compulsory for us to engender growth, stability, and economic prosperity for our people.”

Tinubu on Sunday made a clarion call to “pay attention” to the root causes of poverty and instability in Africa’s Sahel region.

Tinubu also argued that achieving regional stability and growth will only happen through sustained economic collaboration and inclusiveness.

“The rest of the world needs to look at the fundamentals of the problem; not just ordinary geopolitically, but it has to go to the root.

“Has the world paid attention to the poverty level of Sahel and the rest of ECOWAS?

“Have they helped the infusion of capital and paid adequate attention to the exploitation and opportunities availed by the mineral resources available?” Tinubu queried when he fielded questions during a panel session at the Special World Economic Forum in Riyadh, Saudi Arabia.

While calling on bigger economies to actively participate in the promotion and prosperity of the region, he urged global collaboration and inclusiveness to drive capital formation and economic opportunities in Africa.

He recounted the efforts made in his past 10 months as Chairman of the ECOWAS Authority of Heads of State and Government and how he has used Nigeria’s influence to discourage unconstitutional changes in government and ease sanctions for improved trade and economic prosperity in the region.

Tinubu singled out “the fear of lack of capital in Africa” and “stigmatisation” for urgent attention through inclusive programmes that drive economic opportunity.

He emphasised the importance of economic collaboration, saying, “The capital formation necessary to drive the economy, like agriculture, food security, innovation, and technological advancement, must be an inclusive programme of the entire world. No one should be left behind.”

Over 1,000 leaders from business, government, and academia from more than 90 countries are attending the high-profile forum in Riyadh, which is expected to address pressing global challenges across three core themes: revitalising global collaboration, fostering inclusive growth, and catalysing action on energy for development.