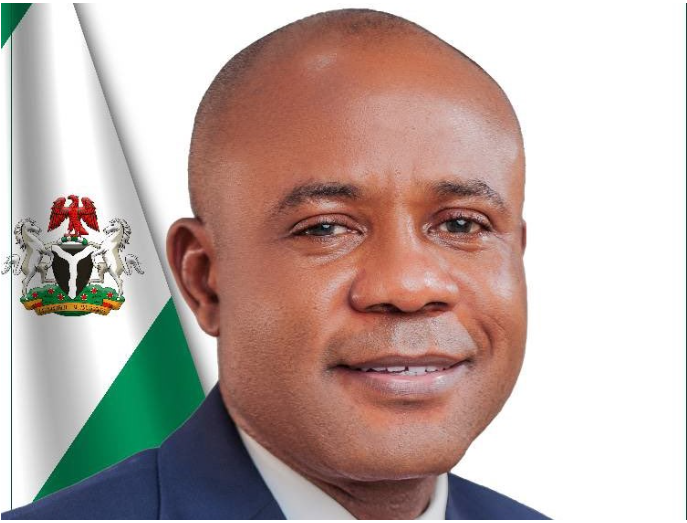

Recalled that Abuja Electricity Distribution Company (AEDC) is currently under the management of the United Bank of Africa (UBA), Fidelity Bank manages Benin Electricity Distribution Company, Kaduna Electricity Distribution Company, and Kano Electricity Distribution Company while Ibadan Electricity Distribution Company is under the AMCON management.They all found themselves under the new management arrangement owing to their inability to repay their loans.The Minister of Power, Chief Adebayo Adelabu, who made this known yesterday to the Senate Committee on Power was in an oversight visit to the ministry in Abuja, that the energy distribution assets are technical and as such, they should be under the management of technical experts.He informed the committee that tough decisions on the DisCos have become necessary because the entire Nigerian Electricity Supply Industry (NESI) fails when they refuse to perform.

According to him, the ministry will prevail on the Nigerian Nigerian Electricity Regulatory Commission (NERC) to revoke underperforming licenses and also change the management board of the DisCos if it becomes the solution.

Adelabu said, “Lastly, on distribution. Very soon you will see that tough decisions will be taken on the DisCos. They are the last lap of the sector. If they don’t perform, the entire sector is not performing.

” The entire ministry is not performing. We have put pressure on NERC, which is their regulator to make sure they raise the bar on regulation activities.” If they have to withdraw licenses for non-performance, why not? If they have to change the board of management, why not?

“And all the DisCos that are still under AMCON and Banks, within the next three months, they must be sold to technical power operators with good reputations in utility management.

“We can no longer afford AMCON to run our DisCos. We can no longer afford the banks to run our DisCos. This is a technical industry and it must be run by technical experts.”

The minister also noted that it has become necessary to reorganize the DisCos for efficiency.

He stressed that Ibadan DisCo is too large for one company to manage.

Responding to the decision to resell the DisCos, a member of the committee, Senator Isah Jibrin alleged that some of the operators have stripped the assets of the DisCos they took over in 2013.

He insisted that the operators of any revoked DisCo must be compelled to fix the assets as they were before handover.

Besides, Adelabu also dropped the hint that the Federal Government mobilized a company named Messr Zigglass with $ 200 million (N32 billion) to supply three million meters that were yet to be supplied to date.

“If you held N32billion for these years, where is the interest”, he asked.

According to him, President Ahmed Tinubu has directed that the contract be revoked.

He said the government will bridge the current eight million metering gap in the next four to five years.

The minister noted that the funding is coming from a seed capital of N100billion and N75billion.He added that the Nigerian Sovereign Investment Authority (NISA) is coming to the aid of the ministry with the fund.

He described the power sector crisis as historical, stressing it has defied all solutions.

Adelabu blamed issues in the industry on uncompleted projects, urging the committee to approve funds for the completion of over 120 projects that litter across the country.

He also noted that the frequent grid collapse was due to a lack of Supervisory Control and Data Acquisition (SCADA).

Responding, the committee chairman, Senator Eyinaya Abaribe dismissed him, stressing that the ministry has been complaining about SCADA procurement in the last 12 years without addressing it.

Besides, Senator Danjuma Goje who is a member of the committee and a former Minister of Power, told Adelabu that nothing has changed in the sector.

Senator Lalong who responded to the issue of the company that abandoned a project after collecting $200million since 2021 noted that people must be punished for their crimes to serve as a deterrent to others.

Speaking Senator Osita Ozunaso called for the cancellation of the DisCos licenses, stressing “DisCos are the problem.”

Meanwhile, Senator Neda Imasuen advised that since the present Managers of the power sector have failed over the years, the government should handle them over to new ones even foreigners.

The same committee proceeded to the Transmission Company of Nigeria (TCN) on the same oversight function, where the Managing Director, Sule Abdulaziz urged the committee to assist in raising funds for the completion of over 120 projects.

He urged the committee to also help in addressing the issue of right of way. The TCN boss sought the committee to make a law that would give the right of way to the projects.

According to him, vandalization is a huge challenge hampering the projects in the North East and South East.

He revealed that the company is collaborating with a Chinese firm to build a super grid.

The N2 billion that TCN gets from the 2024 budget allocation can only pay compensation, he said, pleading for an increased budget.

He added there is a need for funding for new substations.”

In her presentation, Independent System Operator (ISO) Executive Director, Engr. Nafisat Ali revealed that gas has become a major constraint in the industry. She said, “Today there is no gas. We need gas.”

She said the DisCos were still rejecting load despite the power shortage in the country. “The DisCos don’t abide by allocation. That is the challenge,” said Ali.

Adelabu had earlier informed the committee that the federal government owes the Generation Companies over N1.3trillion and also owes the gas suppliers $1.3billion.

He said the gas suppliers have refused to supply more gas because of the debt.

The minister urged the committee to address the debt matter.Addressing reporters at the end of the visit, Abaribe noted that the committee would interface with the federal government to settle the gas debt.

He said: “Every option for us is on the table. If the option is for us to interface with the federal government to do their part, because it is a debt, so they have to pay their debt, we will do so.”

He said he would not doubt the minister that the World Bank SCADA project will be completed in two years.

According to him, the committee will focus its oversight on the ministry and the TCN concerning the implementation of the World Bank project.

He noted that the committee has invited the NERC and other stakeholders to answer some questions concerning the recently reviewed tariff on April 29.

The chairman said the committee would review the penalties for power assets vandalization. (The NATION)